All Issues

Lessons of the Rosen study: District control of water transfers likely to benefit landowners

Publication Information

California Agriculture 46(6):8-11.

Published November 01, 1992

PDF | Citation | Permissions

Abstract

Provided that their districts pursue water transfer opportunities in good faith, landowners benefit from district control of water transfers. Rosen's case study suggests that the value of district control may be substantial. But contrary to Rosen's assertion, tenant farmers need not fear economic loss from water transfers.

Full text

The proper role for boards of agricultural water districts in water transfers is a contentious issue in California. Should boards negotiate transfer agreements and use the revenues to improve district operations? Alternatively, should boards negotiate the best terms on behalf of their landowners? Or should boards simply “stand aside” and allow landowners to negotiate their own transfer agreements with interested municipalities? These questions are widely debated in rural areas and are the subject of pending state and federal legislation.

Michael Rosen's study “Farm-Level Economic Effects of Water Transfers” ( see p. 4 ) provides a valuable case study of these issues. He finds that investing all revenues from a water transfer into district-level conservation projects (his “expanding the resource” option) yields only 7% of the aggregate benefits for landowners and water users in the Imperial Valley as a trading scheme based on negotiated certificates I proposed in 1989. Similarly, he finds that a policy of investing about 25% of the revenues in district-level conservation projects and paying the remainder to growers (his “maintaining the resource” option) fares much better, but still yields only 76% of the benefits obtained under the trading scheme.

Even though the negotiated certificates scheme maximizes the trading value of agricultural water, Rosen argues that it runs afoul on political grounds. More than half the growers in his survey are believed to be made worse off by trading water under the scheme. And, he argues, economic conflict would erupt between landowners and tenants. As a result, he terms the scheme a “rejected policy.”

Rosen's analysis misses key economic dimensions of the negotiated certificates regime. The board would set the financial terms for trading water outside the district. Trading of certificates within the district among landowners and water users would set the price at which available district water would be allocated among water users. Through their control of transactions, boards could defend a substantial differential between the price paid by municipalities and the price growers must pay for water. And tenant contracts would adjust to reflect the new conditions under which water service is available from the district.

While overstating the prospect for intra-district conflict over transfers, his case study illustrates three key lessons for agricultural water interests. Landowners have a substantial economic interest in allowing district boards control water transactions. Boards should organize transactions as the partial offers described below. And the best prospect for trading is in districts where voting deviates from one-person, one-vote.

The trading scheme

A water transfer would follow the model of “negotiated corporate tender offers.” For such offers, the corporate board negotiates the financial terms under which the outside buyer would acquire shares in the target firm. The agreement would be subject to shareholder approval, which is obtained when shareholders sell their stock under the terms negotiated by the corporate board.

Under the scheme of negotiated certificates, the board of a district would negotiate an agreement with an outside buyer, such as a municipality, in its role as trustee for the district's water supply. Under California law, landowners have an “equitable” (that is, they are enumerated beneficiaries of the district trust) and “beneficial” (that is, they are entitled to the profit, benefit, or advantage of the district trust) interest in the district's water. After reaching an agreement with an outside buyer, the board would implement a trading scheme in certificates that quantifies the landowners' equitable and beneficial interest in the district's water supply. The board would first allocate certificates on the statutory basis of water service — assessed valuation of land. It would then repurchase sufficient certificates to supply the water demanded by the outside buyer.

A certificate would have the following privileges and obligations. First, it would allow individuals to purchase a prorated share of the district's water supply at a price that reflects operating, maintenance, replacement, and amortized capital costs. This pricing rule would become a rate covenant to the certificate (that is, it would be unlawful for the board to charge prices in excess of those costs). Second, a certificate would be freely transferable among water users within district boundaries. The value of the water certificate itself — established by demand in the intra-district market — would add to the overall price of water.

The mechanism. The board may repurchase certificates under one of two methods. Under an “any-and-all” offer, the board pays a negotiated price for all water obtained through the repurchase of certificates, provided that purchases meet or exceed a specified minimum quantity. Under a “partial” offer, the board pays a negotiated price for only the specified quantity of water. If landowners offer more certificates than demanded by the outside buyer, purchases would be prorated among those offering to sell certificates.

No landowner would be obligated to offer certificates. For either type of offer, landowners as a group may reject a transaction by not offering sufficient certificates to meet the minimum amount specified by the outside buyer. In such circumstances, the buyer and the board must decide whether to abandon the transfer or increase the price.

It is projected that if a 23-mile section of the All American Canal which traverses sand dunes were lined with concrete, it would conserve 70,000 acre-feet of water annually.

Economic effects. The economic consequences of the scheme result from the two types of transactions in certificates. Landowners must decide what portion, if any, of their certificates to offer for sale to the outside buyer. Landowners and water users must determine whether to participate as buyers or sellers of certificates in the intra-district market. A water user will be a buyer in that market if his water demand exceeds the amount of water available from retained certificates — the certificates a landowner receives in the initial allocation less any sales to the outside buyer. A water user will be a seller if his water demand is less than the amount of water available from retained certificates.

For landowners, they will offer certificates to the outside buyer only if the purchase price equals or exceeds the price established in the intra-district market. For an any-and-all offer, these prices will be identical. For a partial offer, the prices need not be equal. If the outside buyer's price exceeds the intra-district price, landowners would oversubscribe to the offer. The district would prorate purchases. The unpurchased certificates would remain for users within the district.

For water users, the trading scheme increases the opportunity cost of using water. Before the trading scheme, water users only paid the district price for delivered water. Under the scheme, they now pay the district price plus the value of certificates needed to obtain an acre-foot of water. They pay this added cost explicitly if they purchase certificates in that market. They pay this added cost implicitly if they do not sell all available certificates. In either case, a grower would use the quantity of water they demand at the “full price of water” (the price the district charges for delivered water plus the value of certificates needed to obtain an acre-foot of water). In effect, the price of certificates established in the intra-district market creates the economic incentive for growers to conserve water.

For example, suppose a district board negotiated a memorandum of understanding with a municipality to purchase 100,000 acre-feet of water at a price of $100 per acre-foot per year under a partial offer. Before the agreement, growers paid $10 per acre-foot for delivered water. If growers would conserve 100,000 acre-feet per year in response to a price increase of $2 per acre-foot, then the value of certificates needed for an acre- foot of water per year would be $2 in the intra-district market.

For landowners, the trading scheme has two conflicting effects on their economic interest. First, by increasing the full price of water paid by growers, the resulting loss of farm operating income lowers land values. Second, by receiving certificates, landowners have a valuable asset. The net effect depends on whether the loss of farm operating income is greater, or less, than the value of certificates received from the district. In general, landowners are more likely to gain under trading, the greater the price premium paid by the outside buyer (the ratio of the buyer's price to the district's price of delivered water), the less water intensive the crop (relative to the district's average), and the more price elastic the demand for water. (Water demand is more price elastic if, when water prices drop by a given percentage, quantity of water used increases by a greater proportionate amount.) And for partial offers, landowners are also more likely to gain from the trading scheme, the smaller the share of the district's supply purchased by the outside buyer (the smaller the share of water purchased, the smaller the increase in the full price of water and, therefore, the smaller the loss of farm operating income).

The Imperial Valley case study

To implement the transfer contemplated in the Rosen case study, the board would first allocate certificates for the 358,000 acre-feet annual diversion entitlement for the survey farms (about 14% of the Imperial Irrigation District's present perfected rights of 2.6 million acre-feet per year). Lacking data on assessed valuation of land, Rosen allocates certificates on the basis of acreage (6.09 certificates per acre). The district then repurchases certificates for 12,500 acre-feet of water — 3.5% of the aggregate diversion entitlement.

Regulatory reservoirs such as the Carter Reservoir above are being constructed near the terminus of main canals. They conserve water by recovering and storing what would otherwise be lost as operational discharge into the drainage system.

For total water use to decline, Rosen estimates that the full price of water paid by users must increase by $1.40 per acre-foot (that is, $8.90 less $7.50). Given the net delivery losses of about 10.5% (see Rosen's table 2), a certificate for 1 acre-foot of diversions would yield 0.895 acre-foot of delivered water. Therefore, a water user would need 1.12 certificates (that is, 1/0.895) for each acre-foot of delivered water. As a result, the price of a certificate in the intra-district market would be $1.25 ($1.40/1.12).

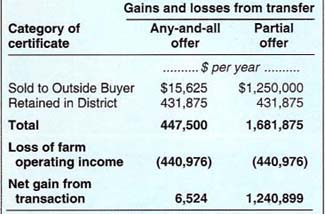

Aggregate gains.Table 1 reports the aggregate gain of landowners and water users from the transfer. Either type of offer increases the full price of water (by $1.40 per acre-foot). Using the aggregate demand elasticity implicit in Rosen's calculations (-0.19), this price increase is estimated to reduce total farm operating income by $440,976.

The value of the certificate allocation depends on the type of offer. For a partial offer, the outside buyer pays $100 per acre-foot per year of entitlement, or a total payment of $1,250,000. The market value of the certificates retained in the district ($1.25 per certificate) is $431,875. For the partial offer, therefore, the total value of certificates equals $1,681,875, or $4.70 per certificate. The net gain of landowners and water users, taken as a group, would be $1,240,899 ($1,681,875 less $440,976).

For an any-and-all offer, the outside buyer must only pay the intra-district price ($1.25 per acre-foot) to obtain 12,500 acre-feet per year. Therefore, the total value of certificates is only $447,500. The net gain from an any-and-all offer would be only $6,524.

The difference in aggregate gains between the partial and the any-and-all offer reflects the value of board control over water transfers. Under the former offer, the board utilizes its exclusive power over transactions to obtain a higher price from the outside buyer than needed for district members to reduce their water use voluntarily. Because of this price differential, the partial offer would be oversubscribed. Under the any-and-all offer, the district members effectively compete among themselves in offering water to the outside buyer. Such competition means that the buyer may obtain any specified quantity of water at a substantially lower price ($1.25 versus $100 per acre-foot per year).

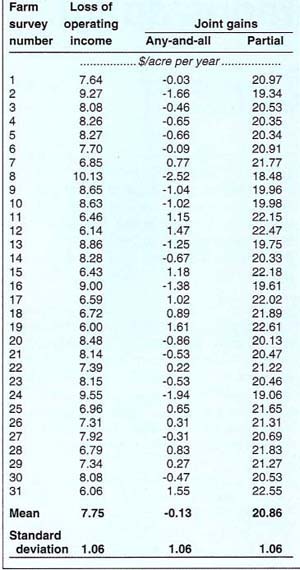

Distribution of joint gains.Table 2 reports the distribution of joint gains of landowners and water users for the survey farms. For a partial offer, landowners and water users in all survey farms jointly gain from the transfer. For an any-and-all offer, only landowners and water users in 13 farms jointly gain from the transfer. The variation in joint gains reflects differences in the per-acre loss of operating income; since both offers increase the full price of water by $1.40 per acre, the loss of operating income is the same. Because the calculations used a common price elasticity of water demand (-0.19), the variation in the loss of operating income is fully explained by the ratio of water use per acre before the transfer. For each additional acre-foot of water used before the transfer, the joint net gains per acre decline by $1.38.

The pattern of per-acre net gains is independent of farm size and only slightly sensitive to the ownership and crop classifications in the Rosen study. According to a regression analysis, an increase in farm size of 1,000 acres yields only an additional 4 cents per acre under either offer (statistically insignificant), a 10 percentage point increase in acres owned yields an additional 6 cents per acre (marginally statistically significant), but a 10 percentage point increase in garden-crop acres yields an additional 27 cents (statistically significant). Especially for the partial offer, the dispersion in per-acre net gains ($1.06) is small relative to the mean net gain of $20.86 per acre.

Landlords v. tenants

Rosen assumes that landlords capture the value of certificates and that tenants absorb the loss in farm operating income. While critical to his conclusions concerning the distribution of economic benefits from water trading, this assumption is not supported by basic economics or the experience of the 1991 Emergency Drought Water Bank.

Economics of contracting. The financial terms of tenant contracts reflect the economic value of land and other resources provided by landlords. The loss of operating income earned by tenants will lower payments received by landlords.

After the implementation of the negotiated certificates scheme, landlords may rent their land with or without the necessary certificates to obtain water service from the district. The financial terms will reflect the inclusion or exclusion of certificates. For example, if the best use of land requires irrigation of 6 acre-feet per acre, then the landlord may either supply the certificates or require the tenant to purchase them in the intra-district market (at a price of $1.25 each). Financial terms in the contract will reflect whether this $7.50 per-acre obligation is assigned to the landlord or to the tenant.

Rosen's analysis neglects these adjustments. In the short run, he argues, contractual terms are rigid. The experience with the 1991 Emergency Drought Water Bank illustrates that tenants may benefit from even unanticipated water transfers.

Under a contract with the Department of Water Resources, Richard Howitt, Nancy Moore, and I interviewed individuals and representatives of districts that sold water to the bank. In our report, we observed: “Some instances were cited where landlords sold water to the bank without a tenant's consent. However, representatives from many areas indicated that some water districts required that landlords and tenants jointly agree to participate in the bank — often, the division of financial proceeds were left to individual negotiations. There also were reports that new contractual arrangements among landlords and tenants address how landlords and tenants will respond to future water banks.” In sum, concern about significant, short-run contractual rigidities is misplaced.

Law v. politics of compensation. In the long run, Rosen concedes, contractual terms will adjust so that tenants do not lose from transfers. To mobilize the political support of tenants, Rosen advocates that districts develop “compensation schemes” to assure that tenants also benefit from water transfers. This call for compensation may run afoul of existing law and, depending on the district, may be unnecessary.

Many agricultural districts are organized under California's Irrigation District Law, California Water District Law, or California Water Storage District Law. Courts have consistently held that these districts are quasi-governmental entities in which landowners, not water users, have an equitable and beneficial interest in the district's water supply. Will districts ignore their trustee obligations to landowners and redistribute a portion of landowner wealth to tenants? If they do, litigation may ensue. The conflict between the local politics of compensation and law will vary significantly among three types of districts.

First, consider those districts where voting is based on landownership and votes are apportioned on the assessed value of land. The politics of voting will conform with the economic effects of water transfers.

Second, consider those districts subject to the acreage limitations of federal reclamation law. The U.S. Supreme Court has held that water service in such districts may not be based solely on landownership. The California Supreme Court reconciled this decision with California law by observing that a district's trustee obligation is defined by the rules and regulations for water distribution under reclamation law. Following this theory, the district may use their policies for distributing federal project water to allocate certificates among landowners and water users. In this circumstance, water users and landowners alike would have an economic stake in water transfers.

Finally, consider those districts where the rateable apportionment of water service is based on land ownership, but voting is based on one-person, one-vote. Landowners may stress the trustee obligation of their district. The district board, in turn, is elected by individuals with no direct stake in water transfers. This situation may be ripe for stalemate.

Conclusion

In the era of water conservation and reallocation, district boards must rethink their trustee obligations to landowners. By controlling trades, they may negotiate better financial terms than individuals may obtain on their own. In the Rosen case study, the outside buyer could acquire 12,500 acre-feet per year at $1.25 if landowners competed with each other. By controlling access to agricultural water, the board may defend a substantial price differential. District control of the transaction would increase the aggregate benefit of landowners and water users by almost 200-fold (from $6,524 to $1,240,899: see table 1).

The Rosen study ignores the conflict over water transfers which will have the greatest consequence for agricultural water interests — the conflict between landowners and district boards. Some landowners and water users are interested in participating in transactions. Blocked by recalcitrant boards, they have supported state and federal legislation (AB 2090, S 484 and HR 5099), which would allow them to bypass board control of transactions. Disgruntled traders may win a battle (engage in trades), but lose the war (receive modest financial terms). But if district boards continue to ignore trading opportunities, they may find themselves stripped of their powers.

For at least some landowners in California, there is reason to believe that some district boards have discovered their mission to organize water trades. In response to the offer by the 1991 Emergency Drought Water Bank to purchase water at $125 per acre-foot, many districts simply apportioned their available supplies among landowners and let them decide whether to sell water to the bank. Facing a set price, all that remained to be determined was which parties were better-off trading water.