All Issues

South Korea-U.S. free trade agreement will lower export barriers for California products

Publication Information

California Agriculture 65(2):66-72. https://doi.org/10.3733/ca.v065n02p66

Published April 01, 2011

PDF | Citation | Permissions

Abstract

The United States and South Korea negotiated a bilateral trade agreement in 2007. After final legislative approval, likely later this year, high tariffs on exports of most California agricultural products to South Korea will be gradually eliminated. Already, with the tariffs in place, South Korea ranks among the top six destinations for many California agricultural exports. More-open access to the South Korean market will create significant opportunities for major commodities produced in California such as almonds and dairy products.

Full text

The Republic of Korea (South Korea) and the United States signed a free trade agreement (KORUS FTA) on April 1, 2007. In 2010, they negotiated a few adjustments to the agreement designed to facilitate approval by each country's legislature. With strong support from the Obama administration, legislation implementing the agreement is likely to be passed in spring or summer 2011. (We refer to the Republic of Korea as South Korea; isolationist and communist North Korea is a separate country.)

When it is implemented, the agreement will lower the trade barriers between the two countries in all sectors of trade. However, although it will benefit other sectors of U.S business, agriculture was central to the negotiations, and potential gains for the United States center around agricultural exports. Unlike the United States, South Korea has maintained high trade barriers for agricultural goods. KORUS FTA would lower those barriers and provide important opportunities for U.S. agricultural exports to South Korea.

The United States is already South Korea's top supplier of agricultural products, worth $3.5 billion in 2007. The South Korean economy is growing and already sizable; with about 50 million consumers, it has a per-capita income ($20,045 in 2007) above that of many European countries. Prices for many commodities are high, and premiums are paid for high-quality produce.

The United States has negotiated a free-trade agreement with South Korea that will greatly reduce tariffs on many California crops. The U.S. Congress is expected to pass the implementing legislation this year. Above, a wholesale produce market in Anyang City, south of Seoul.

The United States has many free trade agreements, most of them longstanding; South Korea has implemented fewer and they are relatively new. As of January 2011, the United States had free trade agreements in force with 17 countries including Canada, Mexico, Singapore, Central America-5 (Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua), Israel, Australia, Chile, Jordan, Morocco, Dominican Republic, Oman, Peru and Bahrain (USTR 2011). South Korea has free trade agreements with Chile, Singapore, ASEAN-10 (Association of South East Asian Nations) and EFTA-4 (European Free Trade Association-4: Iceland, Liechtenstein, Norway and Switzerland). The earliest South Korean free trade agreement was implemented in 2004.

KORUS FTA is especially significant for California agriculture because South Korea ranks among its top six export destinations (Matthews and Sumner 2008), and trade barriers for many agricultural products to South Korea are currently high. In many cases, major exports of California agriculture face tariffs of more than 30%. For some products, including beef, citrus and tree nuts, significant exports are able to penetrate the South Korean market despite high tariffs. Because of the size of the South Korean economy and the height of pre-existing trade barriers, KORUS FTA is considered the most commercially significant free trade agreement that the United States has negotiated in nearly 20 years.

KORUS FTA has little potential to stimulate South Korean agricultural exports to the United States in competition with California products. U.S. agricultural tariffs are already low and production costs in South Korea are high, so few South Korean agricultural products can compete successfully in the U.S. market. Once KORUS FTA is implemented, our assessment is that it will stimulate more demand for U.S. products in South Korea, and the consequences for California agriculture will be slightly higher farm prices, increased agricultural output, additional employment and an expansion of the California agricultural economy past the farm gate.

This paper explores the importance of the South Korean export market for California agriculture and the nature of current trade barriers; shows the schedule for removing tariffs; and explains how the new tariffs arrangement will improve the competitive position of California agricultural exports relative to South Korean products and other countries’ exports to South Korea.

Korean agriculture and trade

South Korea has changed phenomenally during the past half century, from an extremely poor, agrarian economy using 19th-century technology at best, to a wealthy, modern society at the cutting edge of applied science and technology. However, agriculture has not been transformed to the same degree as the industrial and service economies. Protection from imports has kept much of agriculture insulated from competitive pressures. Farm size has remained small, far below average farm sizes in other industrial economies. Furthermore, with limited natural resources, South Korean agriculture has little potential to expand in a freer trade environment.

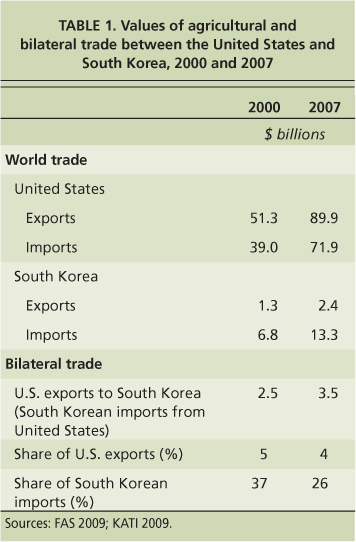

The United States is a major net agricultural exporter and South Korea is a major net importer, reflecting the relative competitiveness of agriculture in each country (table 1). Agricultural goods are especially important commodities in bilateral trade between the United States and South Korea. The South Korean market accounted for 5% (in 2000) and 4% (in 2007) of U.S. agricultural exports, consistently higher than the 4% (in 2000) and 3% (in 2007) of U.S. general merchandise exports that went to South Korea. The United States is the most important source of South Korean agricultural imports, enjoying a 26% share in 2007. Coarse grain represented 24% of the U.S. share, followed by fruits, nuts and vegetables (12%) and meat (11%). In the past decade, U.S. market share in South Korea has declined, mainly due to the growth of competitors including China, Australia and Chile.

TABLE 1. Values of agricultural and bilateral trade between the United States and South Korea, 2000 and 2007

California exports

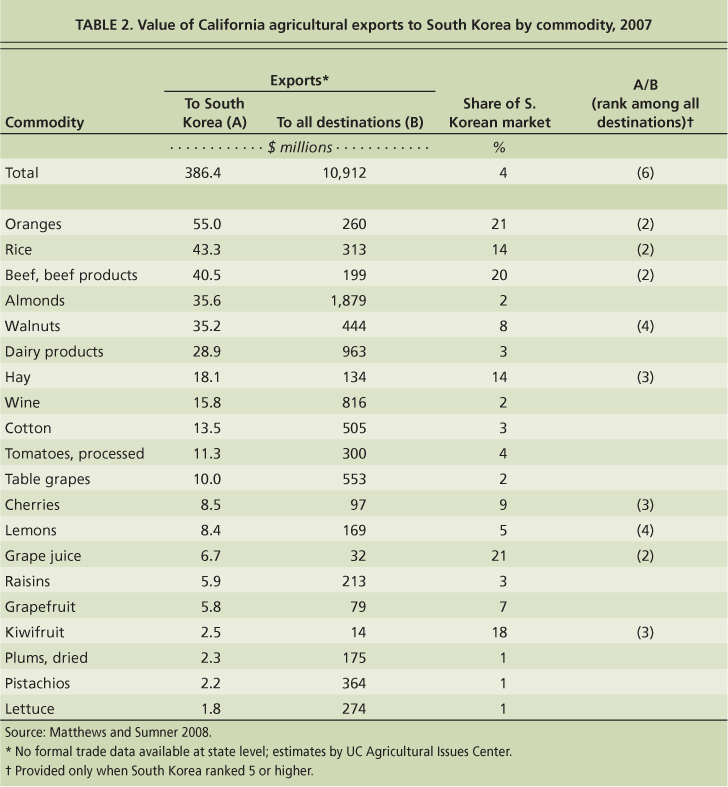

In 2007, the total value of all California agricultural exports to South Korea was almost $400 million (table 2). South Korea was the sixth largest destination for California exports, with about 4% going to South Korea. For some products, South Korea was a much more important destination. Among all export commodities sent to South Korea, fresh oranges top the list, followed by rice, and beef and beef products. In 2007, the bulk of beef and beef products were hides and skins. Before the collapse of exports in 2004 — caused by the discovery of a U.S. slaughter cow with bovine spongiform encephalopathy (BSE) or “mad cow” disease in December 2003 — beef was the most important export item shipped to South Korea from California. Other products that hold double-digit shares of the South Korean market are hay, grape juice and kiwifruit. While the value of almond and walnut exports is about equal, South Korea is a more important market for the California walnut industry than it is for almonds.

Processed tomatoes and lettuce are the only vegetables exported to South Korea, which is not a major vegetable-importing country (table 2). Vegetables accounted for less than 5% of South Korea's total crop-based agricultural imports in 2007 (KMAFF 2008). Moreover, except for a few vegetables — such as processed tomatoes, lettuce and cucumbers — China dominates the South Korean vegetable import market, with a 69% share; the United States is a distant second, with an 11% share (Lee and Sumner 2009).

KORUS FTA will give California suppliers a price advantage over suppliers from nations without a South Korean free trade agreement, and allow California suppliers to keep up with those from nations that have current or prospective agreements with South Korea. When South Korea's free trade agreement with Chile became effective on April 1, 2004, Chilean exports to South Korea grew substantially for kiwifruit, grape juice, lemons, processed tomatoes, wine and whey, which are all major California export products (Lee and Sumner 2009).

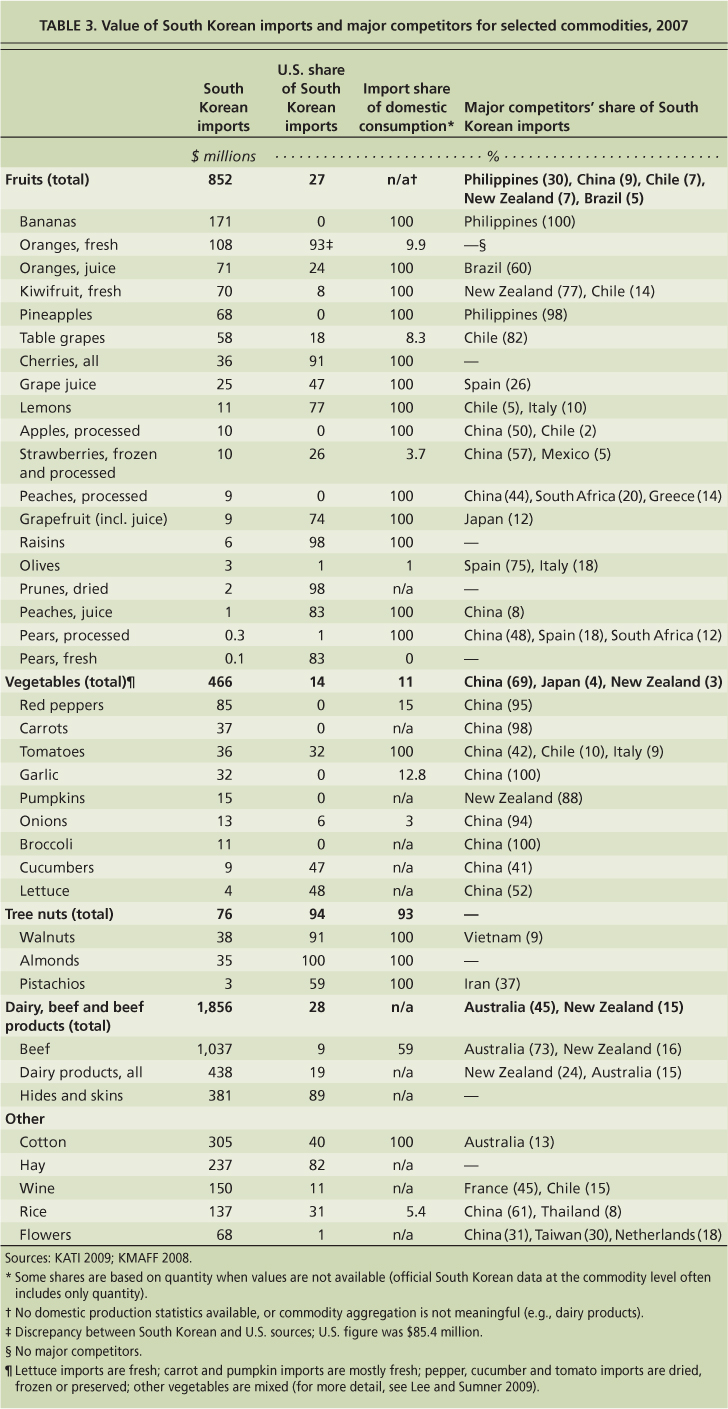

California's major international competitors for trade with South Korea are Chile for table grapes and wine (next to France); Spain for grape juice and olives; New Zealand for kiwifruit, beef and dairy; Australia for beef, dairy and cotton; Iran for pistachios; and China for strawberries, lettuce, garlic, red peppers, rice, flowers and processed tomatoes (table 3).

The potential for California producers to increase exports to South Korea when the market is opened also crucially depends on the competitiveness of South Korea's domestic producers. Imports to South Korea currently represent a small share of the domestic consumption of many major products, such as table grapes, fresh strawberries, fresh apples, lettuce and rice (table 3). Import tariffs for these products are high, about 45% in most cases. Fresh peaches and pears are an extreme example of the closed nature of the South Korean market for some products; South Korea has a sizable market for these fresh fruits, but almost no imports enter the country. Under the South Korea-Chile free trade agreement, preferential (lower) tariffs are applied for all trade between the two countries; however, pears are excluded, and no imports are allowed. The situation for processed fruits is different, with almost all coming from imports. Mostly, imports are low when domestic production is available. Only a few products — oranges, beef, some dairy and hay — are imported when there is also substantial domestic production, indicating that the overseas producers of these products are able to compete with domestic supplies despite sizable tariffs.

KORUS FTA will provide unrestricted market access for certain agricultural crops, phase out many tariffs and impose safeguard measures to protect some domestic crops during the transition. Above, a cargo ship is loaded at the Port of Oakland.

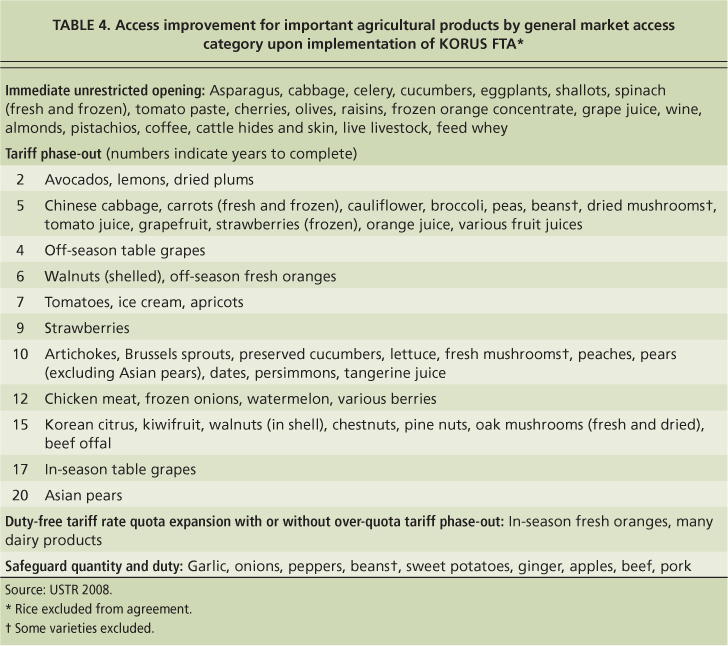

Opening the South Korean market

KORUS FTA defines four mechanisms for establishing better access for agricultural products: (1) the immediate opening of certain markets without restrictions, (2) the phase-out of tariffs over a specified number of years, (3) the expansion of tariff rate quotas (TRQs), with the phase-out of over-quota tariffs and (4) the imposition of safeguard measures (USTR 2008) (table 4). (Tariff rate quotas apply a relatively low tariff for an initial quantity — the “quota” amount — and then a higher over-quota tariff for any additional quantity of imports.) Safeguards will be imposed for some politically sensitive commodities to protect the domestic industry during the transition. Typically, a safeguard trigger level (either a quantity or price) is set, and once it is reached additional duties are assessed to control access to the market.

TABLE 4. Access improvement for important agricultural products by general market access category upon implementation of KORUS FTA∗

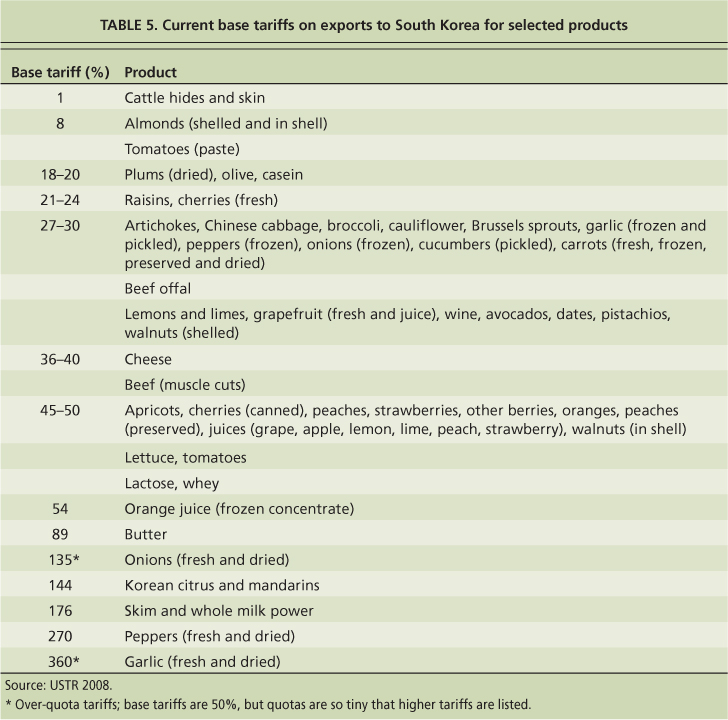

The impact of greater access to the South Korean market will critically depend on the levels of pre-existing tariffs, which vary by product (table 5). Importantly, KORUS FTA allows no additional access for rice, which has a quota allowed under a 1994 World Trade Organization agreement.

Citrus.

South Korea is a major market for fresh oranges and other citrus from California, despite a current duty of 50%. While the agreement lowers trade barriers considerably during the off-season, in-season imports (Sept. 1 to Feb. 29) will still be subject to tight tariff rate quotas. The limited access improvement for in-season oranges is designed to protect the domestic producers of mandarin oranges, which are almost identical to Satsumas and referred to as “Korean citrus” in the agreement. The initial duty-free tariff rate quota of 2,500 tons is equivalent to only 0.4% of Korean citrus produced in South Korea in 2007. Imported oranges are clear substitutes for Korean citrus during the in-season, which is why imports are limited by the 50% tariff. In addition to limiting imports of fresh oranges, South Korea has a 144% tariff on Korean citrus and mandarins from other countries.

While not currently large, South Korean demand for fresh grapefruit, lemons and limes is growing. South Korea is becoming a major export market for California grapefruit and lemons because it does not produce these citrus fruits. Lower domestic prices — resulting from lower tariffs — will further increase demand.

Other fruits.

For most fruits, access is improved under a simple tariff phaseout, but schedules to open the markets for apples, Asian pears and table grapes are more restrictive. These are the noncitrus fruits consumed widely in South Korea. The initial safeguard quantity for apples is 9,921 tons (9,000 metric tons), less than 2.5% of domestic production. Further, Fuji apples, the variety favored by South Koreans, have a long period of market opening with the safeguard duty lasting 23 years (neither apples nor pears currently have access due to phytosanitary issues).

Cherries are the second largest fresh-fruit export from the United States to South Korea, with about 30% supplied by California. The elimination of a 24% tariff is expected to further expand this market.

The South Korean market for grape products is substantial. In 2007, South Korea imported table grapes worth close to $60 million. Table grapes do not face overall quantity restrictions, but seasonal import restrictions apply. Along with the immediate tariff reduction from 45% to 24%, the tariff for off-season imports (Oct. 16 to April 30) phases out in 4 years, and the tariff for in-season imports phases out over 17 years. Chile and the United States (mostly California) dominate the South Korean grape import market. Chile currently holds 85%, in part because its exports are counter-seasonal to South Korean production. About 70% of U.S. table grape exports to South Korea are shipped during their off-season.

The import market for grape juice is also large, exceeding $25 million in 2007, with the United States holding a 47% share. South Korean wine imports reached more than $150 million in 2007, and U.S. wine, almost all from California, accounted for $17 million. Under KORUS FTA, the 30% tariff on U.S. wine will be eliminated immediately. South Korean raisin imports have reached close to $6 million per year, and over 95% are shipped from California. The immediate elimination of the 45% tariff for grape juice and 21% tariff for raisins will allow a substantial reduction in domestic prices in South Korea.

U.S. fresh cherry exports to South Korea rank second highest among all U.S. fresh fruit exports. South Korean fresh cherry exports reached close to $31 million in 2007, with 27% supplied by California. South Korea produces almost no cherries, and the elimination of the 24% tariff is expected to expand the fresh cherry market even further. Among other fruits, strawberries and kiwifruit are promising for market expansion. Strawberries are probably the largest greenhouse crop, by value, in South Korea (no official information is available for greenhouse crops). Currently, no fresh strawberries enter the country, and over 70% of strawberry imports are frozen. China is the number-one supplier of frozen strawberry imports to South Korea, with about an 80% market share, and the rest of frozen strawberry imports are supplied by the United States and Mexico. Kiwifruit is relatively new to South Korean consumers, but imports have grown rapidly and totaled $70 million in 2007. Kiwifruit imports are dominated by New Zealand, which has a 77% share, followed by Chile (14%) and the United States (8%); California supplies about half of the U.S. exports.

Tree nuts.

California tree nuts have a strong presence in the South Korean market. Almond and walnut exports are already substantial (about $35 million each). In South Korea, there is no domestic tree nut industry to offer competition. The United States is the only supplier for almonds and has more than a 90% share in the walnut market. All U.S. walnut and almond exports to South Korea are supplied exclusively by California. The current 8% almond tariff will be eliminated, and in-shell and shelled walnut tariffs, as high as 45%, will be phased out over 6 and 15 years, respectively. Pistachios are relatively new in South Korea and not widely consumed. U.S. exports of pistachios (all from California) are currently small, but with immediate elimination of the 30% tariff, the potential will be large for California growers.

Vegetables.

South Korean tariffs on vegetables will be eliminated either immediately or phased out over time, except for a few sensitive products for which safeguard restrictions apply. We only discuss the vegetables that have significant import value or potential as exports from California. Vegetable trading in South Korea is dominated by China, except for a few products such as fresh pumpkins (New Zealand supplies about 88%), pickled cucumbers (supplied almost solely by the United States) and fresh lettuce (the United States holds about a 50% market share, and California supplies about 41% of U.S. exports).

With a 45% tariff, U.S. exports of lettuce were $4.4 million in 2007. Imports constitute a small share of the domestic South Korean market, which is valued at $200 million. California lettuce competes mostly with off-season, high-cost greenhouse lettuce in South Korea and has substantial export growth potential under the 10-year tariff phase-out. Other fresh, leafy vegetables such as spinach are favored by Korean consumers and also have potential for substantial export growth.

For a few sensitive products the agreement allows gradual access through 18-year phase-outs, with safeguard restrictions. Garlic, onions and red peppers are important ingredients in the South Korean diet and among the major crops in Korean agriculture. The initial safeguard quantities for these products are tiny. They double only after 15 years, and the safeguard duties will remain prohibitive.

Under the free trade agreement, tariffs will be eliminated or phased out for many fruits exported by California growers to South Korea, including watermelon, table grapes and oranges. Safeguard duties and seasonal import restrictions will also apply to some fruits.

California growers provide all walnuts shipped from the United States to South Korea, which has no tree nut industry. In-shell walnut tariffs of up to 45% will be phased out over 6 to 15 years.

Base tariffs for these sensitive products differ significantly depending on the way the product is prepared. While fresh and dried garlic have a base tariff of 360%, frozen garlic has a tariff of only 27%. Predictably, two-thirds of garlic imports are frozen and over 70% of red chili pepper imports, which have a relatively low tariff of 27%, are also frozen.

Beef and related products.

KORUS FTA imposes safeguard restrictions on U.S. beef imports. Beef products are the number-one agricultural import into South Korea by value, exceeding $1 billion in 2007. South Korea became an important market for U.S. beef after its beef market was opened in 2001. The United States had the largest share of imports in December 2003, when South Korea banned U.S. beef following detection of the BSE case in the United States (South Korea accounted for 34% of California beef exports in 2003). Since then, Australia and New Zealand have replaced the United States, together supplying more than 90% of Korean imports.

The United States resumed supplying beef to South Korea in 2007. However, recapturing the market now depends on U.S. competition with Australia and New Zealand as well as domestic producers. Australia traditionally produces grass-fed beef, but producers expanded the production of grain-fed beef for export to South Korea. Under KORUS FTA, the initial safeguard quantity is sizable, amounting to about 60% of domestic consumption. But the within-quota tariff is scheduled to fall by 2.7% each year, providing a price advantage to U.S. producers over their competitors. South Korea also imported a substantial amount of bovine offal ($9 million) and cattle hides and skins ($381 million) in 2007. California's small share of the very large U.S. export total from beef and cattle products is nonetheless substantial for the state's industry.

Dairy products.

South Korea has relatively high trade barriers for dairy products (Lee et al. 2006), but KORUS FTA gradually reduces them. Tariff rate quotas increase gradually with the phase-out of over-quota tariffs. Among dairy products imported to South Korea, the United States has a strong presence in cheese, lactose and whey. In 2007, South Korea imported $179 million of cheese and $144 million of whey, which contrasts to a relatively small milk powder import market ($21 million in 2007). The United States shipped $32 million each of both cheese and whey (trailing New Zealand's $47 million for each). In the same year, California exported $29 million worth of dairy products to South Korea. For cheese, the first-year duty-free tariff rate quota, 7,716 tons (7,000 metric tons) is close to the total of U.S. cheese exports to South Korea in 2007. For feed whey, KORUS FTA allows immediate duty-free access, and the tariff applied to whey exceeding the quota of 3,307 tons (3,000 metric tons) will be reduced immediately from 49.5% to 20% and phased out over 10 years. U.S. exports of lactose to South Korea are also sizable, worth $30 million in 2007, about half of Korean lactose imports. The current tariff of 49.5% is scheduled to be phased out in 5 years under the agreement. Because existing barriers are relatively high for dairy products, KORUS FTA is expected to expand the U.S. share of the Korean dairy market considerably.

South Korea imported $1 billion of beef in 2007. U.S. beef producers currently compete with those from Australia and New Zealand for market share, but gradual tariff reductions will provide a price advantage for the United States.

South Korea's 45% lettuce tariff will be phased out over 10 years, providing substantial opportunities for growers of the California crop, above.

Opportunities ahead

Although South Korea already has an almost open border for many field crops — with the important exception of rice — it has high trade barriers for many vegetables, fruits and animal products that are important in California agriculture. Under KORUS FTA, California has substantial potential to expand its exports of agricultural commodities to South Korea. Lower trade barriers will allow California agriculture to compete in a large, growing and lucrative market. Commodity prices are high in South Korea, and consumers are willing to pay premiums for the high-quality products produced in California. When KORUS FTA is implemented, California agriculture should be in an excellent position to compete on both price and quality.