All Issues

Defying expectations, Asian financial crisis had little impact on California farm exports

Publication Information

California Agriculture 53(5):7-14. https://doi.org/10.3733/ca.v053n05p7

Published September 01, 1999

PDF | Citation | Permissions

Abstract

About a quarter of California's agricultural commodities are exported abroad, and about half of those are destined for Asia. When the Asian financial crisis hit in July 1997, trading losses to U.S. industry, including agriculture, were expected to be substantial. U.S. farm exports to the countries in East Asia most affected by the crisis were expected to decline by about 40% (see sidebar, p. 10), in fiscal 1998 and fiscal 1999. Our analysis, however, has determined that losses to U.S. growers were less, and losses to California growers as a result of the crisis were minimal. We interviewed California executives from the almond, beef, cotton, grape, orange and wine industries, and found no compelling evidence that the Asian financial crisis had a large negative impact on the export of these key California commodities. The Asian economies that were hit hardest by the crisis (Indonesia, Malaysia, South Korea, Thailand and the Philippines) constitute less than 10% of the California export market, which is only 2% of the state's production. In addition, the more mature economies of Japan and Hong Kong continued to import similar quantities from California throughout the crisis; in these richer economies, food imports from California are not all that responsive to changing domestic incomes and prices. And while the rest of the country suffered losses due to declines in grain and oilseed exports, California agriculture is not highly dependent on these crops, allowing growers to adjust more quickly to shifts in foreign demand.

Full text

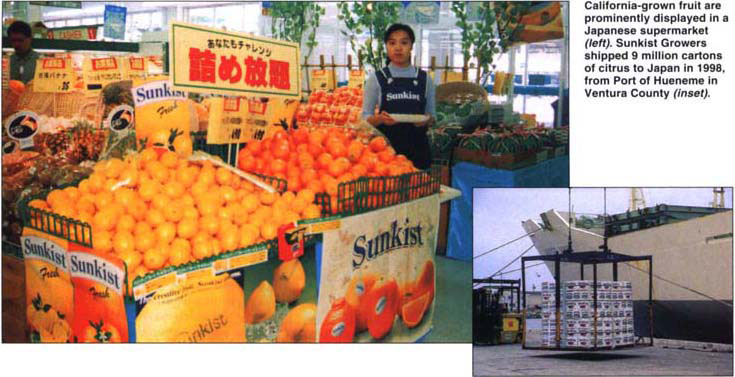

California-grown fruit are prominently displayed in a Japanese supermarket (left). Sunkist Growers shipped 9 million cartons of citrus to Japan in 1996, from Port of Hueneme in Ventura County (inset).

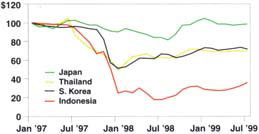

It has been 2 years since the first signs of the Asian crisis caught the world by surprise. In the latter half ot 1997, stock markets and currencies in the region fell between 30% and 50% (fig. 1), and banks collapsed in the Philippines, Malaysia and Indonesia. By late 1999, the region is showing signs of emerging from the depth of the crisis, with currencies and stock markets becoming more stable and investors regaining confidence in these markets. Some markets have returned to or exceeded their precrisis levels. The stock markets in Thailand (32% gain in 1998) and South Korea (117% gain in 1998) both outperformed the U.S. stock market (27% gain) in 1998. The stock markets in the Philippines, Indonesia and Malaysia all rebounded in 1999 (fig. 1). The Indonesian and Malaysian stock markets doubled from October 1998 to July 1999, and the market in the Philippines was up by 30% over this time period.

A Korean container ship awaits cargo at the Port of Oakland. During the first week of September 1999, 5,000 tons of California grapes and 2,500 tons of broccoli were among the agricultural commodities shipped to Asia from Oakland.

The overall effects of the Asian financial crisis on important trading partners such as the United States were initially anticipated as being substantial. (Gajewski and Langley 1998) Whether these perceptions ever became reality in relation to California agricultural exports is doubtful.

It is nonetheless important to analyze closely what has happened. We can then better anticipate future trade developments in these markets, and the effects worldwide. The Asian economies that were hardest hit by the financial crisis (Indonesia, Malaysia, South Korea, Thailand, and the Philippines) constitute less than 10% of the California agricultural export market. But South Korea alone is California agriculture's second or third largest market in Asia, and a major importer of cotton and beef. In addition, in some years, Indonesia imports a significant amount of cotton. Besides South Korea, the other two large export markets for California agriculture in Asia are the mature economies of Japan and Hong Kong.

We provide a brief update of the Asian financial situation to date, followed by a discussion of recent developments in California's trade with Asia.

Asia's financial crisis

Prior to the crisis, emerging Asia was experiencing strong growth in the 1990s and was becoming increasingly important in the global economy. Outside of Asia, there was increased competition among exporting nations, vying to capture the growing markets in Thailand, South Korea, Indonesia, and Malaysia. A significant factor contributing to the growth of the Asian nations was investment from both domestic and foreign sources, which fueled a credit boom in these countries (Goldstein 1998). However, bank-lending standards were lax and business loans were often based on political, rather than financial, considerations. Eventually, nonperforming loans and corporate indebtedness began to pile up. By 1996, exports and growth started to slow and in time the returns to foreign capital started to decline. Foreign investment quickly reversed course and started to flow out of the region in search of higher returns elsewhere. This is what precipitated the crisis.

After the crisis hit, the International Monetary Fund (IMF) extended credit to the region and now there is controversy over whether IMF policies actually helped or hindered recovery. Nonetheless, by the third quarter of 1999, signs of economic recovery emerged in the region. The progress of the Asian economies since the crisis be gan is illustrated with the aid of figures 1 and 2. Changes in exchange rates for Indonesia, South Korea, Japan, and Thailand are shown in figure 2. The data in figure 2 show that all four of the exchange rates depreciated in 1997, with the drop in the Japanese yen less dramatic than for the other three currencies.

The large depreciation of the Asian currencies in 1997 resulted in a decline in total imports into the region, which had worldwide repercussions. ( See sidebar, p. 10 , for U.S. effects.) In terms of the impact on the U.S. economy as a whole, the crisis did contribute to a temporary drop in the U.S. stock market in the fourth quarter of 1997; however, it should be noted that the crisis was a contributing factor and not the sole cause. Overall the U.S. stock market was up strongly in 1997.

California's trade with East Asia

International trade has an important influence over the makeup of California agriculture, as about one-quarter of the value of agricultural commodities produced in California are exported abroad. This represents about 15% of total U.S. agricultural exports. The top eight destinations for California's agricultural exports are Japan, Canada, Hong Kong, South Korea, Germany, United Kingdom, Taiwan and China. It is estimated that about 50% of California agricultural exports are destined for Asia. The top six food product exports from California in 1998 were cotton, almonds, wine, table grapes, oranges, and beef (see fig. 3). The major foreign markets for almonds and wine are in Europe, while significant markets for the other four commodities are in Asia.

For this article we are interested in estimating what happened to California agriculture as a result of the crisis, compared to what would have happened without the crisis. However, there are inadequate figures to completely document what effects the Asian crisis had on California exports. We assembled what statistics were available, and interviewed industry leaders.

Data on California's agricultural exports are not very reliable, because most trade statistics are collected at the national level. See Carter (1997) for a discussion of problems associated with state level trade data. In 1997, the California Department of Food and Agriculture (CDFA) officially reported that California's agricultural exports totaled $11.7 billion in calendar year 1995. Following the 1997 publication, which questioned these trade statistics, the CDFA revised their trade figures and lowered the 1995 export figure from $11.7 billion to $6.5 billion! So, the California agricultural export trade data published in 1997 could have overstated the value of state exports by as much as 80% .

To obtain a firsthand account of the effects of the Asian crisis on California agricultural exports, we interviewed key individuals from the main export sectors. Our sources included California executives who work in the following industries: almonds, beef, cotton, table grapes, oranges, and wine. We interviewed one to three executives from each industry. With few exceptions, executives commented that it was export business as usual, despite the Asian crisis. The fluctuations fell well within the normal range of reversals – such as those caused by unfavorable weather.

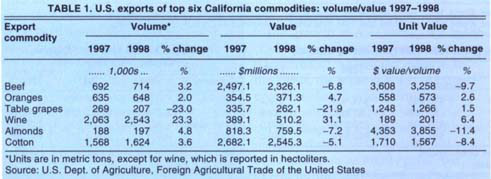

Available U.S. trade statistics support the responses of those interviewed (table 1). In fact, there is no compelling evidence that the Asian financial crisis had a large negative impact on the export of key California commodities worldwide. To the contrary, during the height of the crisis, from 1997 to 1998, U.S. exports (to all destinations) of five of the top six California commodities increased in volume terms: almonds (up 4.8%), wine (up 23.3%), cotton (up 3.6%), oranges (up 2.0%), and beef (up 3.2%). At the same time, the volume of U.S. exports of table grapes declined from 1997 to 1998, by 23% (table 1). This decline in export volume for grapes was due more to weather conditions in California, rather than the Asian financial crisis, according to our sources.

From 1997 to 1998, it appears that world prices may have fallen for some of the export commodities. For instance, even though the volume of beef exports rose by 3.2%, the total dollar value of exports fell by 6.8%, from 1997 to 1998. Dividing total export value by total export volume gives us the “unit” value. This figure declined by 9.7% for beef, suggesting a price fall, unless the 1998 beef exports were of lower quality than the 1997 exports. California exporters of beef to East Asia rely on the Japanese and Korean markets. This trade is in high-quality beef and, according to our sources, it was not adversely affected by the Asian crisis.

The unit values also fell for almonds and cotton from 1997 to 1998. However, the major market for almonds is in Europe, and therefore we cannot blame the apparent price decline on the Asian financial crisis. China's cotton policy may have been instrumental in the fall in the price of cotton.

Fig. 1. Crisis Region Stockmarket Indices from July 1997 to July 1999. For each country, the stockmarket index was adjusted to equal 100 beginning July 1997. Source: http://finance.yahoo.com

Fig. 2. Asian exchange rates relative to the U.S. dollar. For each country the currency exchange rate was adjusted to equal 100 beginning July 1997. Source: http://pacific.commerce.ubc.ca/xr/

Fig. 3. California's agricultural exports in 1997. Source: California Department of Food and Agriculture

Impact on California

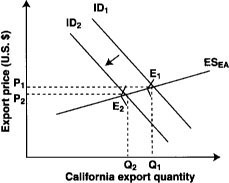

California exporters are highly responsive to demand fluctuations overseas. When the Asian crisis hit, they adapted quickly and successfully to the drop in demand of a few small customers. The crisis led to a shift of the import demand schedule (the crisis region imported less quantity at a given price) due to the relative appreciation of the U.S. dollar and the decline of income growth in the importing region.

Figure 4 shows that if California has a small customer whose demand has changed, this demand shock is relatively easy to accommodate without a large impact on the price. The same would not necessarily be true for a demand shock within a region that was a large customer.

We know that in general, for a small customer, the California export supply schedule ESEA is relatively flat (or “price elastic” – meaning the quantity exported is highly responsive to small price changes). The reason is that California exporters quickly reduce shipments to the affected region (to match demand) and spread a little greater supply among other large customers. With the demand curve shifting leftward along the elastic supply curve, the impact will mostly fall on quantity traded, rather than price. In figure 4, the U.S. export price falls a relatively small amount from P1 to P2 and the volume of trade declines significantly from Q1 to Q2.

Other ways California is different

In addition to the crisis, there were other significant changes in the supply and demand fundamentals during this time period. Nonetheless, the summary trade statistics in table 1 are consistent with the conclusion that the crisis had no large negative impact on California agriculture.

California is different from other major agricultural states in the nation in that California tends to export numerous high-valued commodities, which are aimed at high-income consumers. Unlike the bulk commodities, such as grains and oilseeds, which were experiencing stagnant import demand growth in Asia even prior to the crisis, demand was growing for California's high-valued exports. In the 1990s, the most significant import growth in Japan was in fruits, vegetables, and beef. This growth occurred despite the fact that Japan's domestic production of agricultural products remains highly protected due to import trade barriers. For instance, under the semblance of phytosanitary concerns, Japan continues to restrict the import of several U.S. fresh fruits, vegetables, and other horticultural crops (U.S. Trade Representative, 1998). Of course, there are exceptions to these trade barriers that are important to California. For example, raw cotton imports enter Japan duty free.

Japan trade effects

The Japanese economy has been sluggish for most of the 1990s and it slipped into a recession (with falling real GDP and relatively high unemployment) in 1997 and 1998. Despite a deteriorating economic situation, the value of Japanese agricultural imports (in yen) did not fall significantly in recent years. According to Japanese import data, Japan's 1997 agricultural imports totaled 4,366 billion yen, up from 4,298 billion yen in 1996. For 1998, the figure was 4,288 billion yen. The value of Japan's vegetable imports grew by 6% from 1996 to 1997, and then again by 14% from 1997 to 1998. Japanese imports of fruits and nuts also grew over this period. Most remarkable was increased wine imports by Japan, growing by an estimated 25% to 30%, in value terms, in 1998. Wine is California's third most important export commodity. In 1998, Japan replaced Canada as the second largest market for U.S. wine exports (behind the United Kingdom). U.S. wine exports to Japan totaled $92 million in 1998. Perhaps recessions lead to high consumption of imported California wine!

Freight from around the world is delivered through Hong Kong's Victoria Harbor for distribution locally and in Asia.

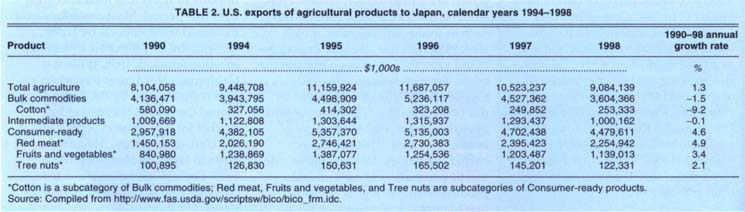

More detailed agricultural trade statistics on Japan are reported in table 2. These data summarize U.S. exports to Japan from 1990 to 1998. The total value of U.S. agricultural exports (measured in U.S. dollars) grew at an annual rate of 1.3% during this period, despite a decline in the growth of the value of bulk commodity exports (-1.5% per annum). Most of the decline in the value of bulk commodity exports was due to a sharp drop in U.S. cotton exports to Japan (down by 9.2% per year over this period). The figures in table 2 indicate that the value of U.S. export of intermediate products to Japan fell slightly over the 1990 to 199S period, and this was mostly due to a decline in exports of hides and skins.

In contrast to bulk and intermediate goods, U.S. exports of consumer-ready agricultural goods to Japan showed a strong growth rate of 4.6% per year.

Red meat, fruits, vegetables and tree nuts all enjoyed growth in sales to Japan over this period.

Hong Kong trade effects

The second largest Asian destination for Californian agricultural exports is Hong Kong. In contrast to Japan, Hong Kong is a free market economy, and is considered to be the most open agricultural market in the world. Hong Kong is an important market; it also serves as a passageway for imports into China. It has been estimated that from 50% to 60% of Hong Kong's fruit imports are re-exported to China. In addition to the official agricultural trade between Hong Kong and China, there is considerable smuggling into mainland China (Foreign Agricultural Service, 1996). This is especially true for horticultural and animal products. For instance, China prohibits imports of oranges from the United States, but fresh U.S. oranges can be purchased almost anywhere in China. If this smuggling were to be stopped, China's food imports from California would be considerably lower than they presently are. This means that exporting nations such as the United States do not complain about the rampant smuggling. Products with very high import tariffs and restrictive import quotas would be most affected if smuggling from Hong Kong to China were forbidden.

China largely unaffected

Importantly, the financial upheaval did not spread to China. The stock market in China did not experience a sudden drop in 1997-98 and China was able to maintain its exchange rate at around 8.3 renminbi to the U.S. dollar. The fact that China more or less weathered the financial crisis was critical. If instead, China had been forced to devalue its currency in order to boost its trade performance, the weaker Asian neighbors would have felt the impact through reduced exports and the Asian crisis would have undoubtedly been more pronounced. This is not to say that China was totally immune from the financial crisis in the region, given China's dependence on trade within Asia. The value of China's exports failed to grow in 1998, and partly as a result, economic growth slowed from double digits to 7.8% in 1998 (according to the official statistics, which may be upward biased). Urban unemployment also rose to unusually high levels in China in 1998 and 1999. International concern remains over whether or not China will devalue this year or next.

Cotton trade

In dollar terms, over 50% of U.S. cotton is exported to Asia. The most consistent Asian export markets for cotton are Japan and South Korea. China, the world's largest cotton producer, is an erratic cotton trader, exporting in some years and importing in others. Taiwan, Thailand, and Indonesia are also significant importers.

China's cotton imports have declined over the recent years, which is part of a continuing trend that originated prior to the Asian financial crisis. This led to a corresponding fall in world prices. China's government decided to raise domestic prices and encourage cotton production rather than import from overseas. As a result, China now has one-half of the world's cotton stockpile and in fiscal 1998/1999 China is (once again) expected to shift from a net importer to a net exporter of cotton. It had been a net importer for the previous 5 years.

However, the Asian crisis and China's oversupply were not the only factors affecting California's cotton trade. Poor weather conditions resulted in lower yields and a delayed crop harvest. The 1998 cotton yield in California was the smallest in many years.

Beef trade

Import demand for beef is thought to be somewhat price- and income-sensitive However, in the case of California beef, the impact of the Asian crisis was not as severe as was originally expected. In fact, in 1998 the volume of high-quality beef exported from California to Japan and Korea was about the same as in 1997. For the United States, the volume of beef exported to Japan actually increased by 6.5% from 1997 to 1998. However, the 1997 to 1998 volume of U.S. beef exports to Korea fell by 40%, according to USDA data.

Korea is also a leading market for U.S. cattle hides, accounting for about 40% of U.S exports. This trade is not trivial, as Korean imports of hides exceed the value of its beef imports by a factor of about two. The impact of the Asian crisis was clearly noticeable in the hide market. Korean tanneries ran into credit problems and quickly reduced their imports. As a result, prices fell from $70 to $30/ head, at the height of the crisis. Prices have since risen to more normal levels and trade volume has picked up, partly due to the USDA's allocation of $100 million in GSM-102 credit for hide sales to Korea.

California exports about 200,000 boxes of table grapes to Thailand annually, in a Bangkok fresh juice shop, Red Globe grapes are destined for the blender.

Fruit, vegetable, and nut trade

California table grape producers are becoming more and more trade dependent as production is growing faster than domestic demand. The California table grape industry exported an estimated $330 million in table grapes to offshore markets in the 1997 season, with about one-third destined for Asia. The major Asian export market is Hong Kong, which imported about $90 million in grapes in 1997. An unidentified percentage of these imports are smuggled into to China, which has a 45% tariff on fresh grape imports. In the years prior to the Asian crisis, export volumes to the region were steadily rising. As mentioned above, during the past year, table grape export volumes have dropped (table 1). This is partly due to the Asian crisis However, the weather in 1998 also had a significant detrimental impact on the grape crop, resulting in the overall quality of the crop) being reduced. This in turn reduced the quantity of good quality grapes reaching the Asian ports. Exports to Latin American markets have taken up some of the demand slack experienced in the Asian markets and the diversification into Latin America has helped reduce any impact of the Asian crisis on Californian grape producers.

The foreign demand for Californian almonds during the Asian crisis remained steady overall. California accounts for 75% of the world's trade in almonds. About two-thirds of the almond crop is exported each year, 10% of which is destined to Asia. The main markets in Asia are Japan and Hong Kong. The Asian crisis did not affect the 1997/1998 crop year and in fact there was an inaease in exports in that year. The effect on the industry was modest because the share of the total crop that is exported to Asia is considerably small and almonds are exported in diversified product forms, which helps spread demand risk, unlike the case for some of the other key export commodities such as cotton.

California orange producers export about 30% of their total output, a large share of which is destined for Asia. The 1998 volume of U.S. exports exceeded exports from 1997 t table 1). The weather played a factor in enabling California to maintain expert volumes to the Asian region. Taiwan suffered typhoons, which damaged their pineapple crop, and which led to more imports of California citrus. In California, there was also a late and poor quality grape crop and a late stone fruit crop, which left a void in the market, which was partially filled by citrus exports. Overall the orange export business (volume and value) between California and Asia has remained relatively the same as it was prior to the Asian financial crisis.

Summary

The countries hardest hit by the Asian financial crisis were not major import markets for California farmers. Countries that were marginally impacted, for example Hong Kong, China, and Japan, maintained their import demand for California's agricultural products. Overall, the major export commodities such as cotton, almonds, wine, beef and oranges did not suffer a significant reduction in demand due to the Asian crisis. Those commodities that did suffer a decline in demand are a relatively small share of California's overall agricultural export value, with table grapes a possible exception. Our conclusion is that California exports dropped little as a consequence of the crisis.

Within Asia, currency devaluations improved agricultural export competitiveness, and at the same time, increased the domestic prices (in local currency) of agricultural products. So many local Asian farmers actually benefited from the financial crisis. While we cannot make the same claim for California farmers, at least they were not unduly harmed.