All Issues

With fewer acres, more mechanization: California leads Spain in almond production, exports to world

Publication Information

California Agriculture 47(6):11-15.

Published November 01, 1993

PDF | Citation | Permissions

Abstract

With rapid expansion of almond acreage since the late 1960s, California has become the world's dominant almond producer and the major supplier in export markets. Spain, the world's number two producer, has more than three times California's acreage, but its comparatively low average yields have limited its penetration of export markets. This article examines differences in the two almond producers, particularly with regard to yield and response to economic incentives.

Full text

California and Spain dominate world production and trade in almonds. For the three marketing years 1989–1990 through 1991–1992, California accounted for an average of 66.3% of the world's almond production; Spain's average share was 17.1%. Of total almond exports during the same period,. California accounted for an annual average of 80.1%; Spain accounted for 15.9%. Other major almond producers — Turkey, Italy, Greece, Morocco and Portugal — collectively accounted for 16.6% of world production and for only 4.0% of exports.

California and Spanish dominance of the world almond market is a recent development. Italy was the world's major almond producer as recently as the late 1960s. California's almond acreage expanded dramatically from the early 1960s through 1980. The sharp expansion of Spanish almond acreage began 2 to 3 years later and continued until 1980. As almond production expanded in California and Spain, Italy's production decreased. California's production first exceeded Italy's in 1966 and has continuously exceeded Italy's since 1969; Spanish production exceeded Italy's in 1971.

The California and Spanish almond industries have similarities, such as patterns of growth, but there are also major differences. This article compares and contrasts almond production in these two areas, based on the view that international marketing requires a global view of competitors and their capabilities. The changing yields and acreage in California and Spain are analyzed.

Almond acreage

California almond acreage totaled 113,100 acres in 1960. It more than doubled during the 1960s to 232,300 acres in 1970 and continued to grow to 389,000 acres in 1980. Growth slowed during the 1980s, with acreage totaling 431,900 acres in 1990. Spanish almond acreage also expanded dramatically from 407,700 acres in 1960 to 737,800 acres in 1970, exploding to 1,394,300 acres in 1980. Expansion continued to 1,516,100 acres in 1990. Almond acreage in Spain is now 3.5 times greater than in California.

California's almond industry is concentrated on irrigated acreage in the San Joaquin and Sacramento valleys. “New” in a historical sense, California's almond industry is made up of highly mechanized, relatively large production units. The 1987 U.S. Census of Agriculture reported 6,717 farms with 427,685 acres of almonds, for an average size of almost 64 acres. When the 2,449 farms with less than 15 acres are removed from the total, one finds that there were 4,268 farms with 412,897 acres for an average of almost 97 acres of almond trees per farm. In 1987, there were 104 California farms with 500 acres or more of almonds.

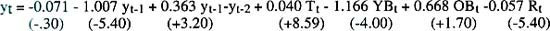

EQUATION A: Estimated yield for California almonds

with t-ratios in parentheses and the variables defined as follows:

EQUATION B: Estimated yield for Spanish almonds

with t-ratios in parentheses and the variables defined as follows:

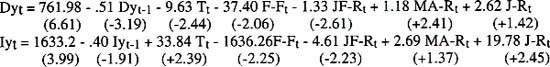

EQUATION C: Estimated net annual change in California almond acreage

with t-ratios in parentheses and the variables defined as follows:

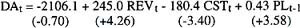

EQUATION D: Estimated net annual change in Spanish almond acreage

with t-ratios in parentheses and the variables defined as follows:

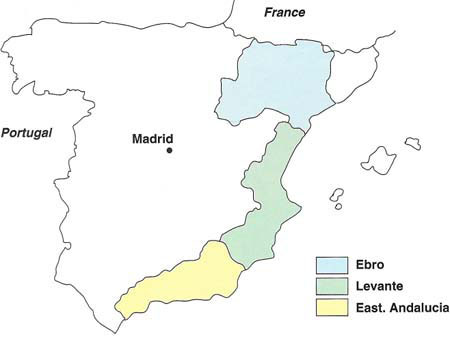

Almond trees have been traditional in Spain since Arab domination more than 500 years ago. Although almond orchards are widely dispersed throughout Spain, commercial production is concentrated in the Mediterranean regions (fig. 1). Approximately three-fourths of Spain's total almond acreage is located in three regions — the Ebro region to the north, the Levante region in the center and eastern Andalucia to the south. The Levante region, which includes Valencia, currently accounts for onethird of Spanish almond acreage. Fewer than 112,000 of Spain's 1,516,100 acres of almonds are irrigated; most irrigated acreage is located in the Levante region.

The Spanish almond industry is best characterized as consisting of thousands of very small units, most of which are located in arid areas. Almond production is typically a sideline for farmers who rely on other enterprises for income. Large-scale specialized almond production units are the exception in Spain. Although the area devoted to almond production has increased rapidly, the industry has not evolved into a modern, efficient competitor.

Average yields

Average annual almond yields in both California and Spain vary with alternate bearing tendencies and weather conditions during the bloom period. Spanish yields for dryland almonds are also affected by rainfall during the growing season. California yields are much higher than Spanish yields. For example, California growers had an average yield of approximately 1 ton (1,996 pounds, in-shell, or 1,198 pounds, shelled, using an average conversion factor of 0.6) per acre during 1985–1989. Overall Spanish yields during the same 5 years were approximately 389 pounds per acre, in-shell. Spanish dryland yields averaged approximately 318 pounds per acre, in-shell; irrigated yields averaged approximately 1,197 pounds per acre, inshell. Because of low yields, annual total Spanish almond production has recently averaged about one-fourth of California's, even though Spain has more than three times the acreage. A model of average annual California almond yields was estimated for 1950–1990. This model included variables to measure the impact of alternate bearing, an upward trend in yields due to improved technology, the changing age structure of trees and rainfall during the bloom period in February and early March. The estimated yield equation is Equation A (see box). These results are generally consistent with expectations and they track the data well.

The coefficient of determination (R2) of 0.82 indicates that the variables included in the equation account for 82% of the variation in annual almond yields. The coefficient on lagged yield is close to -1, which indicates that yields tend to be distributed symmetrically around the normal value due to alternate bearing. This implies that any year's yield is expected to be below (or above) normal by the same amount as last year's yield was above (below) normal. The small positive coefficient on the change in yield from 2 years ago to last year is consistent with the idea that some changes in yield persist to some extent for more than 1 year. The coefficient on trend (T) indicates that average annual yields increased 0.04 ton per acre over the 40-year period. The coefficients on the variables for young and old trees are plausible.

As the proportion of young trees rises, average yield falls, and as the proportion of old trees rises, average yields rise. The latter result was unexpected, but not implausible if the majority of trees in the older category has been relatively young — that is, trees at their peak yield rather than trees in decline. In any event, the coefficient was not significantly different from zero by statistical standards. Finally, as expected, increased rainfall during the bloom period in February resulted in lower average yields. A rainfall variable for March did not add to the explanatory power of the yield equation and was not included in the final equation presented.

An adaptation of the California yield model that considered differences in production methods and data availability was estimated for Spanish almond yields. Because of the emphasis on dryland production in Spain, one would expect rainfall during the growing season to be an important determinant of yields. Separate equations for dryland and irrigated almonds were estimated for 1971–1989. The estimated yield equations are Equation B (see box).

Variables included in the Spanish yield equations differ from some of those in the California equation. Variables for the proportion of young bearing (YB) and old bearing acreage (OB) were not included since data on the age distribution of Spanish almond trees were not available. The variable for lagged yields (yt-1-yt-2) did not add to the explanatory power of the equation and was dropped. The yield equation for dryland, which is most of the acreage, explains a much higher percentage of the annual variation in yields than does the equation for irrigated yields, as measured by the coefficient of determination (R2) statistics of 0.75 and 0.42 for dryland and irrigated acreage, respectively.

Above, Spain has more than three times as much almond acreage, but California's irrigated orchards (below) and mechanized farming practices produce almond yields four times greater per acre.

There was an annual downward trend in average Spanish dryland yields of approximately 9.6 pounds per acre during 1971–1989. At the same time, annual irrigated yields increased approximately 33.8 pounds per acre. Overall, there was a slight downward trend in Spanish yields because of the high percentage of dryland cultivation. January-February rainfall and February frost had the expected negative impact on yields; increased rainfall during the growing season was associated with higher yields, even on irrigated acreage.

Of the several factors that explain Spain's low almond yields, the lack of irrigation systems in arid areas is a major cause. Spanish almond trees are also especially sensitive to late winter frosts; the most common varieties of Spanish almonds bloom early, making them vulnerable to late winter and early spring frosts. Because of this phenomenon, there is an interest in introducing later blooming varieties. We have no information on Spanish use of bees for pollination, but given the small-scale nature of the industry, this could be another reason for low yields.

Most expansion of almond plantings has occurred on poor land. Perhaps because Spanish farmers traditionally devoted land to almond orchards that competed only with olives, they believed that almonds would yield profits even on marginal land. Such a planting policy has obviously contributed to low yields. The nature of the problem can be illustrated with aggregate data. Between 1965 and 1990, total land area planted to almonds increased by a factor of about 2.5, but almond production increased by a multiple of only 1.8.

Other structural problems are hard to overcome. In most cases the irregularity of the terrain and the small size of the orchards forbid mechanization. Almonds are still harvested mainly by hand; mechanical harvesting, along with its accompanying cultural practices, is barely utilized. Hand harvesting is particularly labor intensive, and because of the small size of the orchards, it is undertaken mostly by families. This situation could change in the future, however, as family labor becomes scarce. One can speculate that reduced labor would have two impacts, a move toward mechanical harvesting and a reduction of marginal acreage not suited to mechanical harvesting.

Changes in almond investment

Almond production varies from year to year as yields vary and over time as acreage adjusts in response to producer decisions regarding plantings and removals of almond trees. Detailed analyses of plantings and removals over time indicate that net investment in almond production is largely an economic decision in both California and Spain. Almond producers, in aggregate, tend to increase acreage in response to favorable profit expectations and decrease acreage in response to unfavorable profit expectations. Although the process by which producer profit expectations are formed has been modeled in various ways, expectations are most often based on recent experience with revenue and costs. Estimated empirical relationships for net investment in almond production are presented for both California and Spain.

A model of annual net changes in California almond acreage was estimated for 1951–1990. The model included variables to measure the impact of revenues, costs and recent plantings. The estimated equation for net annual change in California almond acreage (annual planting minus annual removals) is Equation C (see box).

These results are generally consistent with expectations and the variables included on the right-hand side of the equation explain about 66% of the variation in the net annual change in California almond acreage. California almond producers have tended to increase new almond plantings and decrease removals when almond prices and revenues increased, other factors being equal. As expected, their response to cost increases was to decrease plantings and increase removals as costs increased. Increased new plantings in the previous year (t-1) were also associated with increased net investment in year t.

There is some evidence, from previous research, that changing income tax laws could affect producer decisions on tree crop plantings and removals. Variables to directly measure the impact of tax law changes on almond plantings and removals were investigated, but preliminary results were mixed and inconclusive. Research on the impacts of changing tax laws on almond acreage response continues.

A model of annual net changes in Spanish almond acreage, similar to the California model, was estimated for 1965–1989. The model included variables to measure the impact of revenues, costs, government planting subsidies and the acreage of trees in various age categories. The estimated net annual change in Spanish almond acreage (total acreage in year t minus total acreage in year t-1) equation is Equation D (see box).

These results are generally consistent with expectations and the results of the acreage response equation for California. The variables included on the righthand side of the equation explain more than 80% of the variation in the net annual change in Spanish almond acreage.

Spanish almond producers have tended to increase new almond plantings when average prices increased and have reduced acreage when costs increased. They have also tended to increase investment as old almond acreage increased. Spanish producers reacted, as expected, to government planting/production incentives and subsidies effective during 1969–1979. The estimated coefficient on the subsidy variable indicates that Spanish acreage increased almost 16,000 acres more annually during 1969–1979, when the subsidies were effective, than during other years when subsidies were not available to almond producers. The estimated coefficient on the variable for 1972 indicates that acreage increased over 56,000 acres more than expected that year. While some 16,000 acres can be explained by government subsidies, no explanation is offered for the development of the additional 40,000 acres.

The significant increases in Spanish almond acreage and production that occurred during the 1970s can be largely explained by the Spanish government's planting subsidies and supports, which were associated with an increase of about 175,000 acres, and by generally favorable almond prices which encouraged producers to significantly expand their investments in almond production.

Conclusion

California and Spain, the world's two major almond producers, expanded almond acreage and production significantly during the late 1960s and 1970s. Their production systems differ. California acreage is irrigated, high yielding, mechanized and large scale; most Spanish acreage is planted on dryland, is small scale, is not mechanized, utilizes family labor, has low, variable yields and is a secondary enterprise for most producers. As a consequence, California's higher yields result in an average annual production that is some four times larger than Spain's on less than one-third the acreage.

Analysis of producer acreage response indicates that producers in the two countries respond to similar factors. Both California and Spanish producers tend to expand acreage when prices increase or costs decrease and tend to decrease net investment when profit potential decreases. Spanish producers also react, as expected, to planting/production incentives and subsidies. Although California producers do not enjoy similar explicit subsidies, one would expect them to react similarly if such subsidies were available. This similarity in economic behavior is important to the decision-making of California producers. Actions taken by California producers to increase almond prices will encourage increased production by their major international competitors if these higher prices are transmitted (as they surely will be) to international markets.