All Issues

Domestic, world market growing … Grape juice concentrate emerging as a sweetener in juices, food products

Publication Information

California Agriculture 47(5):28-31.

Published September 01, 1993

PDF | Citation | Permissions

Abstract

The domestic and world market for grape juice concentrate is growing. We discuss several options that may enable the San Joaquin Valley's grape industry to capture a larger share of this growth market.

Full text

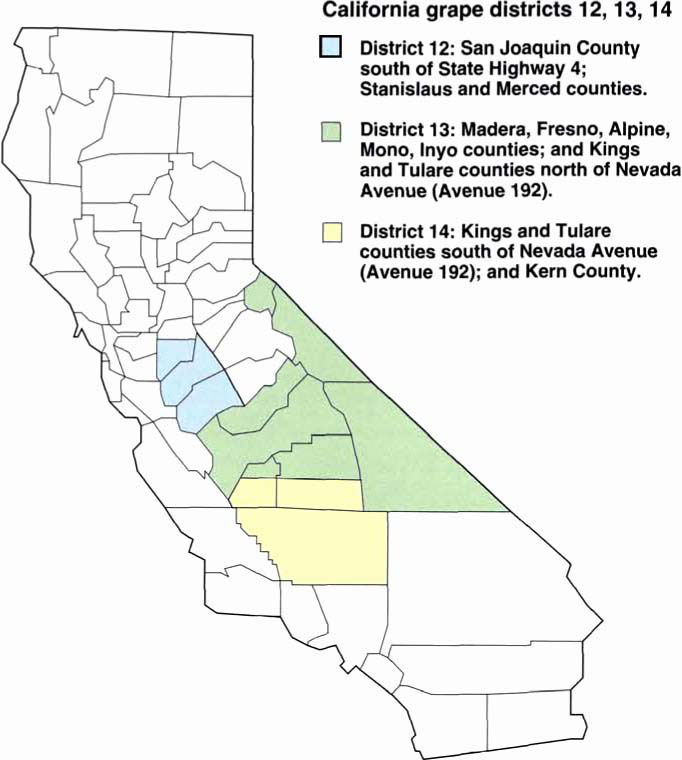

Grape juice concentrate, an emerging growth industry, is used in making grape and multifruit juices and in sweetening food products. Production in California increased to approximately 462,000 tons in 1991, accounting for 28% of the 1991 San Joaquin Valley crush (grape districts 12, 13, and 14, see map). The concentrate, produced by heating grape juice under a vacuum to remove water, competes with apple and other fruit juice concentrates as well as sugar, mainly on a price basis.

San Joaquin Valley grape growers generally view concentrate as a market for surplus grapes, just as wine was once a market for grapes not marketed as table grapes or raisins. Over time the wine market has relied increasingly on wine-specific varietal grapes and on grapes grown in California's coastal areas. Today, the grape juice concentrate market is filling the surplus grape market role. Just as grape production changed in response to wine industry demand, grape production for concentrate could become a primary market for San Joaquin Valley growers. This article examines the prospects and problems in making this transition.

The concentrate market

Grape juice concentrate is diluted into single-strength grape juice and multifruit and sparkling juice. It also sweetens jams and jellies, yogurt, frozen fruit desserts, cereals, cookies and other bakery products. Fruit concentrates are replacing table sugar and corn syrup as many consumers perceive fruit concentrate as a healthier sweetener. Consumers favorably view products labeled “no sugar added.” In 1989, when white grape juice concentrate sold for $4.50 a gallon, the costs of grape juice concentrate and table sugar were similar. Now, grape juice concentrate is slightly more expensive.

Sparkling juice sales in the U.S., totaling 37.3 million gallons in 1989, are growing 15% annually. Sales of spreadable fruits are also increasing at the same rate. Demand for products containing fruit concentrate is expected to continue.

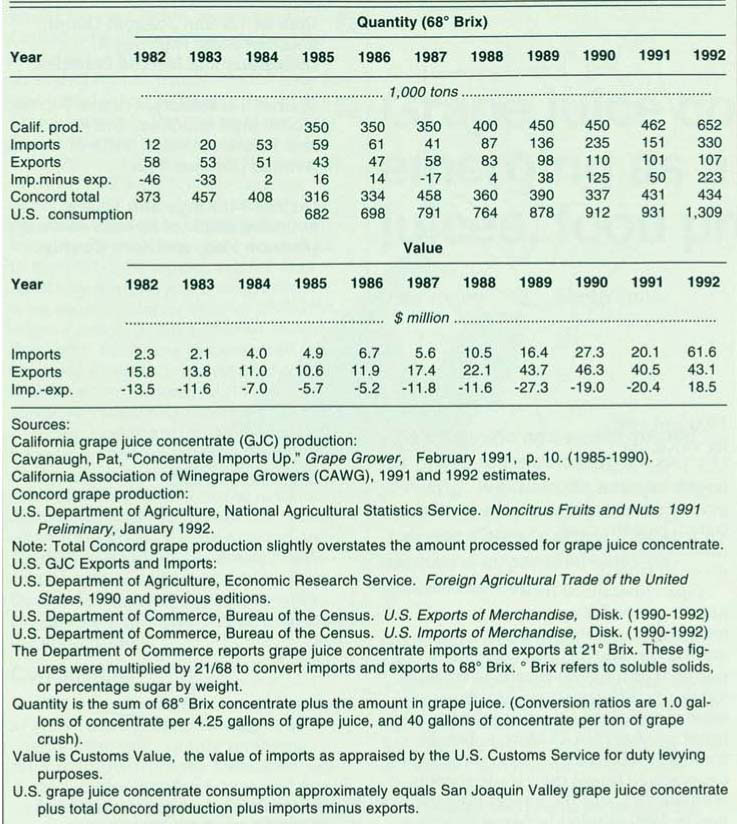

U.S. grape juice concentrate is primarily supplied by several varieties grown in the San Joaquin Valley and by the Concord variety in New York and other northern states. Table 1 presents basic U.S. grape juice concentrate production and trade.

The price of grape juice concentrate is strongly affected by the worldwide supply of apple juice concentrate, which accounts for approximately 72% of U.S. fruit concentrate consumption. Apple and grape are close substitutes for multifruit and sparkling juices. Apple juice concentrate prices fluctuate with the level of apple juice concentrate imports and the amount of the U.S. apple crop processed into concentrate. For example, in 1991, the prices of all fruit concentrates rose substantially as fewer apples were diverted into concentrate due to fears surrounding the use of the growth regulator Alar. The price of apple juice concentrate in 1993 plummeted because of bumper apple harvests in Germany and Eastern Bloc nations, and because a larger share of the U.S. 1992 apple crop was diverted into apple juice concentrate. The price of grape juice concentrate tends to fluctuate with that of apple.

International market

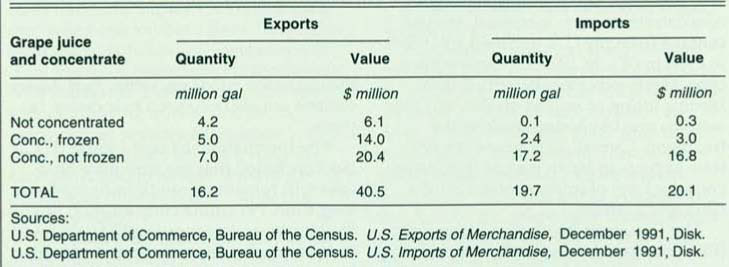

Grape juice is exported in three forms: frozen and unfrozen concentrate, and juice. It is typically sold in concentrated form and processed in the importing nation. The U.S. generally exports higher-value frozen concentrate and grape juice and imports lower-value unfrozen concentrate (table 2). U.S. exports are Concord (Vitus vinifera) from northern states and a limited amount of Muscat from the San Joaquin Valley. U.S. exports of grape juice concentrate have steadily risen. Imports increased sharply in 1990 and 1992. (Because we have grouped several varieties produced at different times in different countries, imports and exports may rise simultaneously.)

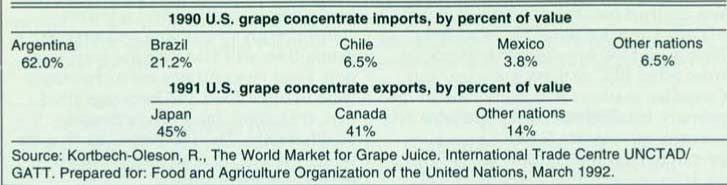

Argentina supplied 62% of U.S. grape juice concentrate imports in 1990, but its exports have since declined as a result of high inflation, increased domestic wine prices and poor weather. Hail and untimely rains reportedly devastated Argentina's 1993 grape juice concentrate export prospects as well. But other nations, notably South Africa, are boosting their exports to the U.S. and contributed to a record level of U.S. grape juice concentrate imports in 1992.

U.S. apple juice concentrate imports are also becoming less dependent on Argentina. The growing number of important apple concentrate exporters will tend to stabilize the prices of all fruit concentrates.

The value of U.S. grape juice concentrate exports increased rapidly to $43.7 million in 1989 and declined slightly in 1990 and 1991. By value, the U.S. is the world's largest exporter of grape juice concentrate. The pattern of this trade for 1990 is given in table 3.

Japan liberalized fruit juice imports, lifting grape juice quotas in 1990, and has quickly become the fifth largest importer of grape concentrate, in terms of value. Quality-conscious Japanese processors prefer the Concord grape, which is not produced in California. Before trade liberalization, Japan favored U.S. exporters to lessen their trade surplus with the U.S., but the import liberalization in 1990 enabled Japanese fruit processors to choose more freely. As a result, although Japanese grape juice concentrate imports increased, the percentage from the U.S. declined from 95% in 1989 to 64% in 1991. U.S. grape juice concentrate exporters benefited from Japan's lifting of import quotas, but they were harmed by losing preferential treatment. Overall, U.S. grape concentrate exports to Japan rose as Japan's increasing level of imports offset the declining U.S. share.

The European Economic Community (EEC) markets for fruit concentrates are currently of limited interest because of EEC trade barriers. EEC's customs duties for fruit concentrates are up to 50% of their value for non-EEC exporters. Nearly all EEC concentrate imports are from other EEC nations. Japanese and Canadian markets will likely remain the primary markets for U.S. grape juice concentrate exports. South Korea is expected to eliminate import restrictions on grape concentrate in the 1995–1997 liberalization program. Other East Asian nations are also expected to increase imports.

Fig. 1. Varieties grown in grape districts 12, 13 and 14 are candidates for the emerging concentrate market.

The International Trade Centre (ITC) has concluded that the fruit juice business will remain a growth industry for a long time. Per capita consumption of fruit juices and nectars is still fairly low in most markets. Consumption of fruit juices is projected to increase due to greater health consciousness. Innovative packaging by bottlers and retailers, coupled with advertising and aggressive promotion, will also increase consumption. Fruit concentrates are increasingly used in other food and beverage products, including dairy products and health drinks. The ITC estimates that the world market for fruit juices will grow strongly in the future.

Enhancing concentrate sales

In this section, we discuss the avenues open to industry to increase demand for grape juice concentrate and to make it more competitive with other concentrates.

The U.S. $1-per-gallon duty charge on imported grape concentrate generated $3,276,033 in revenue in 1991. The San Joaquin Valley concentrate industry could petition that at least part of the import duty be used to fund generic promotion. The petition would be more likely to succeed if the industry were already collectively promoting and researching, as was the case with the Florida Citrus Growers.

Industry organization

San Joaquin Valley's grape concentrate industry is not organized to implement programs outlined here. In response, several valley grape growers have formed the California Fruit Juice Growers (CFJG), a voluntary organization of grape, apple and pear producers whose fruit is crushed for concentrate. As an alternative, other commodity groups have enacted commissions to ensure that all industry members contribute and that profitable research and marketing may be supported. The programs mentioned here cannot be implemented without active industry participation.

Conclusion

Grape concentrate is a growing market, thanks to an innovative industry and consumer preference for fruit sweeteners over table sugar. Grape concentrate is diluted into grape and other fruit juices, and also sweetens a limited but increasing number of food products. World grape juice concentrate trade is competitive, but growing. There are several options for San Joaquin Valley grape growers to capture a larger share of the fruit concentrate market. These options include developing new varieties and viticultural practices suited for concentrate, developing precise, uniform grades for concentrate and engaging in generic and export promotion that broadens industry understanding of how concentrate may be used. Enacting these and other options may enable grape concentrate to join table grapes, raisins and wine to become the fourth primary market for California grapes.